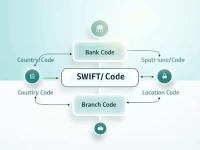

Guide to SWIFT Codes for Global Money Transfers

This article highlights the significance of SWIFT codes in international remittance, using BARCLAYS BANK UK PLC as a case study. It details the steps involved in transferring money to France, along with the processing times and fees associated with various payment methods. Readers will learn effective strategies for cross-border transactions.